Reasons to Choose an Assupol Funeral Plan

Click on the Plus + for More Info

Click on the Plus + for More Info

You can make changes to the cover amount for each person until you are satisfied with your monthly premium. For an individual person, the price starts from just R21 p/m.

For an additional premium, you can decide to stop paying premiums after you turn 65 without losing any policy benefits. The policy will continue for all lives insured.

With this optional benefit, you can make funds available for your family for up to 6 months after your death. This money can assist the family with anything they need financially.

Once all the claim documents are received, Assupol will settle claims within 24 hours. In some cases claims settle even sooner.

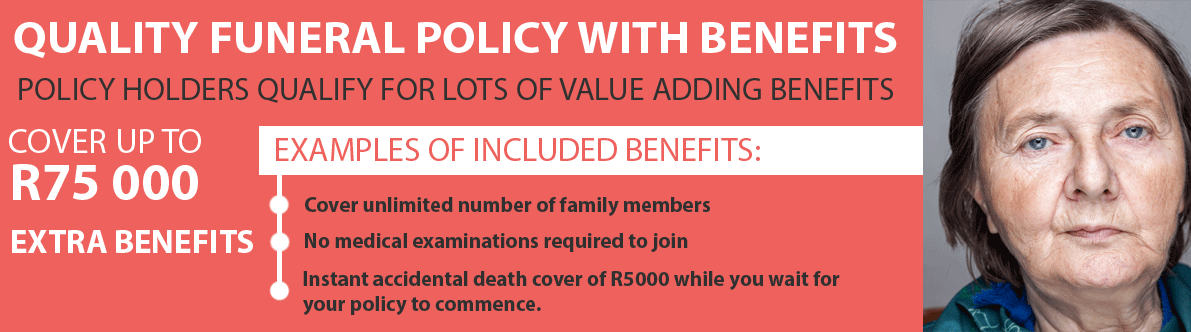

Your acceptance into an Assupol Funeral Plan is guaranteed. You do not have to undergo medicals or answer medical questions to join.

All lives insured will receive instant accidental death cover from acceptance date to the start of the policy.

There is no limit to the amount of family members you can cover under one Assupol Funeral Plan.

For an additional premium, you can guarantee insurance for your family, without them having to pay any premiums after your death.

With this additional benefit, you can get cashback every 4 years even if you claim. This is money straight to your pocket.

This benefit includes a wide range of personal support. Examples include: Transport of deceased persons, trauma counseling, transport in medical emergencies, and other helpful information on funeral, medical and financial matters. This part is automatically included in your policy.

This Assupol Funeral Plan website is administered by InShoor™, a registered financial services provider FSP# 43216. Please note, we are not a traditional lead aggregator. We generate leads for our own use. All leads will be handled by our own friendly staff members. Your privacy is our priority, we do not give your information to the providers we represent unless you sign up for a funeral plan.

This site is dedicated to Assupol Funeral Cover. You can find all the information you need right here. To go back to the main site with all the providers we represent, please click here.

Assupol is one of the biggest and most trusted funeral policy providers in South Africa. They offer a wide range of automatic and additional benefits. Our helpful agents will explain all the benefits and help you structure the policy to fit your needs. Our quotes are free. It does not cost you anything extra to sign up using our humble service. With Assupol, you can get from R5000 all the way up to R75 000. You can get a policy today from as little as R34 p/m.

Assupol is a very well-known name in the industry. They offer a wide range of insurance products not limited to funeral cover. However, they have one of the best polices in the business. Not only can you get cover up to R75 000, you can also cover unlimited family members under your policy. They have a nationwide footprint. One of the most important things to consider when shopping for a funeral plan is the quality of the provider. With Assupol, you know you will not have issues when it’s time to claim. They have the reputation to prove it.

Assupol has been around since 1913. This means they have more than a 100 years’ worth of valuable experience. They pride themselves on the fact that they design products for the South African market. They understand your needs and make sure the take care of them. The Assupol Funeral Plan comes with a many free and additional benefits. You can tailor make your policy to fit your changing needs. Our opinion is that this is one of the best products available on the market today.

Additional benefits include but are not limited to: cashback, premium waiver, double accidental death cover, income benefit, memorial benefit, etc. This is just one of the many ways Assupol make their policy stand out above the rest.

A very important feature of this policy is great customer service. With the Assupol funeral plan, customer gets access to Assupol On-Call. This is a toll free number that offers a lot of assistance. It’s included in the policy and offers 24 hour access to transport of deceased persons, transport in medical emergencies, trauma counseling, and helpful information on funeral, medical and financial matters. For an additional premium, you can also opt for On-Call Plus. This benefit gives you valuable support like instantGroceries™, cellphone airtime, electricity and transport. This is paid within minutes. This is a fantastic benefit to help make things easier for you when you need it the most.

This is a question many South Africans ask. As a matter of fact, this is a great question. Firstly, everybody will die someday. Unfortunately, it costs a lot of money to arrange a burial with dignity. A burial plan or funeral policy will help lessen the financial burden. A funeral plan makes money available quickly when an insured live is lost. You pay a small monthly premium to cover you and your family. When a person who has cover dies, the beneficiary can claim a cash amount.

The money is made available as soon as 24 hours later. This means that there will be money available to take care of everything. Another advantage of a funeral plan is all the value adding benefits. Most funeral policies come with additional benefits. Some benefits are automatically included, while others are at an additional cost. You can structure the policy to fit your needs.

Funeral insurance should be an important part of your portfolio. As mentioned earlier, everybody will pass away. Death does not discriminate. It does not matter how old or how healthy you are. Everybody needs burial insurance. It’s the responsible thing to do. With Assupol Funeral Cover, you can cover an unlimited amount of family members. You can also cover your children, even if they are older than 21. In South Africa, a lot of families rely on a single bread winner. This policy makes it possible to cover the vulnerable members of your family.

Additional Benefits:

Family income benefit

With this benefit, you can support your family for up to 6 months after your death. Money will be made available to assist them with day to day requirements.

Memorial Benefit

This benefit pays out 5 or 11 months after the death of an insured life. This amount can be used for the memorial or wake.

Double pay-out on accidental death

In the event of accidental death, the cover amount will double. For example, if you have the maximum cover amount of R75 000, in the event of accidental death, the payout will be R150 000.

Guaranteed cash back

With this benefit, you will receive cashback every 4 years, regardless if you claimed or not.

Premium Waiver – Retrenchment

If you get retrenched, your family will remain covered for up to 6 months. This will alleviate some of the pressure of the loss of income.

Assupol On-Call

This is a toll free 24 hour phone assistance. Information about medical matters, ambulance and transport in a life threatening emergency, admission fee to a medical facility, trauma counseling, tutor assistance to children, information about financial matters, discount on funerals etc.

On-Call Plus

This benefit makes payments within minutes. You can get money for airtime, groceries, transport, and electricity. This money can be spent countrywide at shops like Checkers, Pick & Pay, Shoprite, etc.

Health+

This benefit activates after 3 or more consecutive night in hospital. The benefit provides cover for non-medical expenses as a result of hospitalization.

Assupol funeral cover is our latest addition to the family. At InShoor, we make sure we represent only the best. We firmly believe that Assupol will be one of our top products. We have full confidence that the Assupol funeral Plan will offer our clients nothing but the best.

A notable advantage of this policy is you can get up to R75 000 cover. This is the highest amount we offer. Secondly, you can cover as many family members as you need to. There is no limit on the amount of people you can cover.

You have the option to add value adding benefits to your policy. You are in control of how much you spend per month. With extra benefits like premium waiver and Assupol On-Call Plus, you can rest assured that you and your family will be in good hands.

Yes you can. There are no medical questions or examinations to undergo. You acceptance is guaranteed. Please note, there is a 6 month waiting period for natural causes. They do this to prevent terminally ill people from taking out a policy last minute. You will however receive accidental death cover from the first premium. You will also receive R5000 accidental death cover while you wait for you policy to activate.

Assupol settles claims within 24 hours after receiving a valid claim. In some cases this can be even faster. It’s important to submit your claim documents as complete as possible. This will prevent any delays in your payout.

When you sign up for your policy, you get to select the beneficiary of the money. We always suggest that you nominate a person you can trust. It’s also not advised to choose a person who is below 18 years old. It’s important to discuss this with the person you nominate. Make sure the person is aware of your policy.

The premiums are determined by you. The cost depends on the amount of people, ages and cover levels you choose. The older a person is, the more expensive it will be to cover said person. At the end of the day, we want you to be comfortable with your monthly premium. We can help you structure the plan until you are satisfied with the amount it will cost every month.

The good news is there is no limited to the amount of family members you cover under your plan. You can even cover your children for their whole life.

Each optional benefit will be calculated according to the amount of cover you need. When we do your quote, we can include or exclude additional benefits according to your needs. We will guide you every step of the way.

In short, you need this policy to cover the expenses of a burial. To burry a person with dignity costs a lot of money. Not having money can be devastating. With this policy, you can ensure that funds will be available quickly and effectively. The money can be used for anything you or your family needs at the time.