Introduction to Assupol Funeral Cover Premiums

Like most insurance products, there is a monthly cost to get an Assupol Funeral Policy. On this page, we will look at how they determine the cost. We will also look at how the process works. There are a couple of factors that will define how much you pay. For the most part, there are only a couple of things that will influence the cost. Let’s look at some of the important factors you need to know

Your Age is a Deciding Factor

Firstly, one of the most important factors is your age. The older you are, the higher the risk. This is because as we age, our risks increase. This is mostly because of natural causes but can also be due to accidents. It does not matter how old you are, you are always at risk. However, the older you are the higher your risk for some critical illnesses. One of the first things most providers look at will be your age. This is why we usually suggest you don’t wait too long before you get cover.

The Amount of Cover is a Deciding Factor

Secondly, Assupol funeral cover premiums link directly to the amount of cover. Most providers offer cover from around R5 000 to R75 000. To make it easy to understand lets break it up a bit. Each premium is based on the amount of cover you take. This means that if you pay R10 for R5 000 cover, it will cost R20 for R10 000. You have the ability to choose how much cover you need. It’s important to make sure you do not over spend. In this economy, it’s very easy to live on the edge. Many providers will not allow you to take more cover than you can afford. This is to protect you against overspending.

Optional Policy Benefits

Lastly, some providers have extra benefits that are not included by default. Because there are so many cash only policies, providers have to be inventive with benefits. Some of these benefits will be included; others will be at a cost. This is to make the policy stand out above the rest. Some of these benefits will give you extra money for certain things. You can add extra benefits to make your policy fir your needs. Most policies will be sufficient with the default benefits. However, some extra benefits can add a lot of value to your policy.

Beware of Useless Benefits

As a side note, we want to warn our readers against useless benefits. We always say nothing is for free. This is a sad truth you must be take into consideration. We have seen funeral policies with ridiculous benefits. Some give you discounts on your armed security, discounts at take away shops, a free cellphone, etc. The benefits do not improve your policy. Some companies call these benefits something silly like “Living Benefits”. We believe that benefits that do not improve your product will worsen it. Some shady providers use random benefits to lure customers. In most cases, these benefits will likely never be used but will be worked into the cost. Obviously Assupol benefits do add value. The above is just to make you aware of this issue.

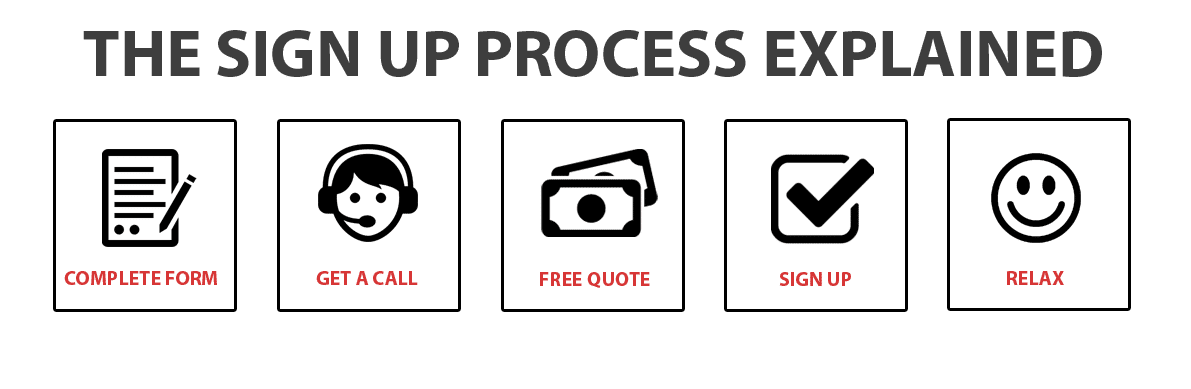

How Do I Get My Free Quote?

If you are still reading this page, we are sure you are ready to get cover. With our service, you can get a free no obligation quote. If you are not completely happy with your free quote, you can simply through it away. It does not cost you anything extra to use our service. We offer our clients free quotes from top providers. If you decide to sign up for an Assupol funeral cover, we will do all the hard work for you… To get started, please complete a contact form anywhere on our website.