Who Can I Include in my Assupol Quote?

Introduction

Firstly, let’s look at a couple of things before discuss the topic. Most funeral plans will allow you to cover a whole bunch of people. Local providers understand the importance of letting you cover your family. There are many single income households in South Africa. Because of this, providers will usually allow you to cover direct and indirect family. When you request an Assupol quote from us, we will help you add all the people you need.

Direct Family First

Usually the first people you add to your Assupol quote is your direct family. This will mean your spouse & kids. A spouse will mean a husband & wife, or even boyfriend and girlfriend. You do not need to share the same surname to qualify. In this section you can cover your spouse and up to 5 children. This would be the starting point in your Assupol quote.

Extended Family Members

We feel that Assupol got this section right. Most funeral insurance providers will only allow you to cover extended family up to the age of 76. In most cases, you will also only be able to cover up to 9 extra members. This is not always enough.

In your Assupol quote, you can cover an unlimited amount of extended family up to the age of 79. This makes a big difference. We strongly feel that this is one of the best features of the plan. They clearly understand the needs of our nation. It’s important to have the option to cover all the people you care for.

Beneficiary of Your Plan

Now that we have discussed who you can include in your Assupol quote, let’s look at the next important part.

When you apply for an Assupol funeral plan, you need to select a beneficiary. This person does not have to be in your actual plan. What I mean by this is you do not have to get cover for this person. You can if you have to but it’s not necessary. This can be any person you trust with your payout.

Discussing Your Needs

Remember, this person will be in charge if you pass away. You must make sure that this person is of legal age and will take care of everything on your behalf. It’s important that this person is aware that they are the beneficiary of the plan. We know it’s not fun but discuss the plan and needs with this person.

When the time comes to submit a claim, this person will be in charge. They must be aware of your policy. Also we always suggest you discuss what you want. Everybody will die one day. Most of us have some requests. Tell this person what you expect of them.

Getting an Assupol Quote Online

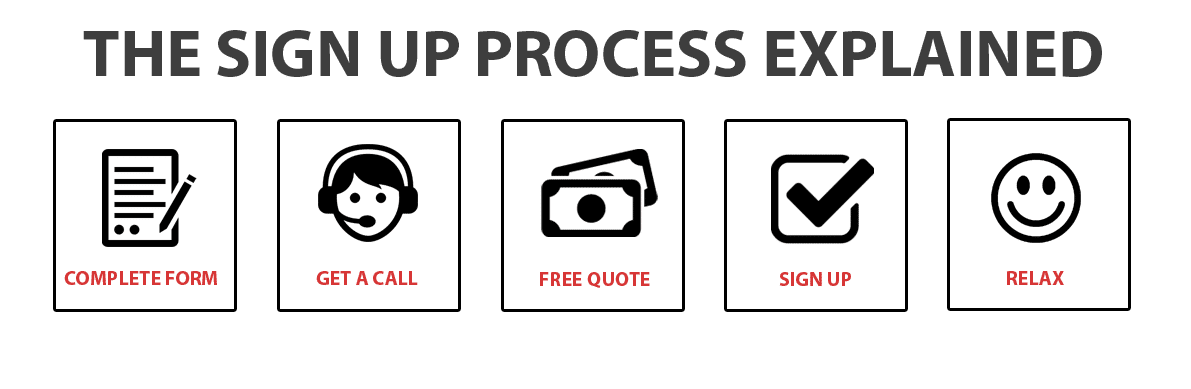

Lastly, we want to discuss the process of getting a quote. We are a registered financial services provider. This means we can do your quote over the phone and even sign you up quickly and hassle free. It does not cost you anything extra to use our service. We get compensated by the provider for all the policies we render. This amount is not added to your premium.

The advantage of using our service is the level of care and support we offer. We have been awarded top AVBOB broker nationally every year since 2012. We hope to achieve the same award from Assupol soon. This is a new product we offer. We believe that we will soon be one of the biggest Assupol brokers in South Africa.

Conclusion

To get your Assupol quote from us is quickly and hassle free. We assign just one agent to you to take care of you throughout the process. We believe that this is one of the best funeral insurance products on the market. Give us the opportunity to give you a free Assupol quote. No strings attached.

One Response

Prince

Assupol funeral cover for extended family.